How Manufacturers Leverage Field Sales Intelligence for Strategic Customer Relationships

In manufacturing, your ERP system excels at tracking transactions, orders, and shipments. But what about the relationships behind those transactions? When executives prepare for critical customer meetings, they need more than sales figures - they need context, history, and insight that can only come from your field sales team.

Christian Wettre

EVP, GM North America

The Hidden Gap in Customer Intelligence

Consider a typical scenario: Your executive team is preparing to visit a major customer with twelve locations across five states, three divisions, and decades of history. Do your executives truly understand what's happening across this complex relationship? Or are they walking in with incomplete information hastily compiled from fragmented sources?

For most manufacturing organizations, it's the latter. The problem isn't a lack of information - it's that the information exists in isolation. Spreadsheets maintained individually by reps, handwritten notebooks that never get digitized, tribal knowledge locked in people's heads, email threads buried in inboxes, and informal conversations that are never documented.

When executives walk in half-prepared, several problems emerge: missed opportunities for cross-selling, reactive positioning instead of strategic leadership, weakened relationships, and improvised strategy. The customer can sense when their supplier doesn't have a complete grasp of the relationship - and that perception creates risk.

The Power of Connected Systems

The solution lies in systematically capturing and surfacing the knowledge your field sales team generates every day. The true power emerges when information flows bidirectionally: your ERP provides the transactional foundation - orders, shipments, invoices, and service tickets - while your CRM interprets this data for your sellers, adding critical relationship context from emails, meeting notes, phone calls, and customer service interactions.

Your ERP system knows that a customer placed three orders totaling $47,000 last quarter. Your CRM explains why: two orders came after a plant visit where your rep identified a production bottleneck, and the third resulted from a service issue that your team resolved quickly. This bidirectional flow transforms raw transactions into strategic narratives.

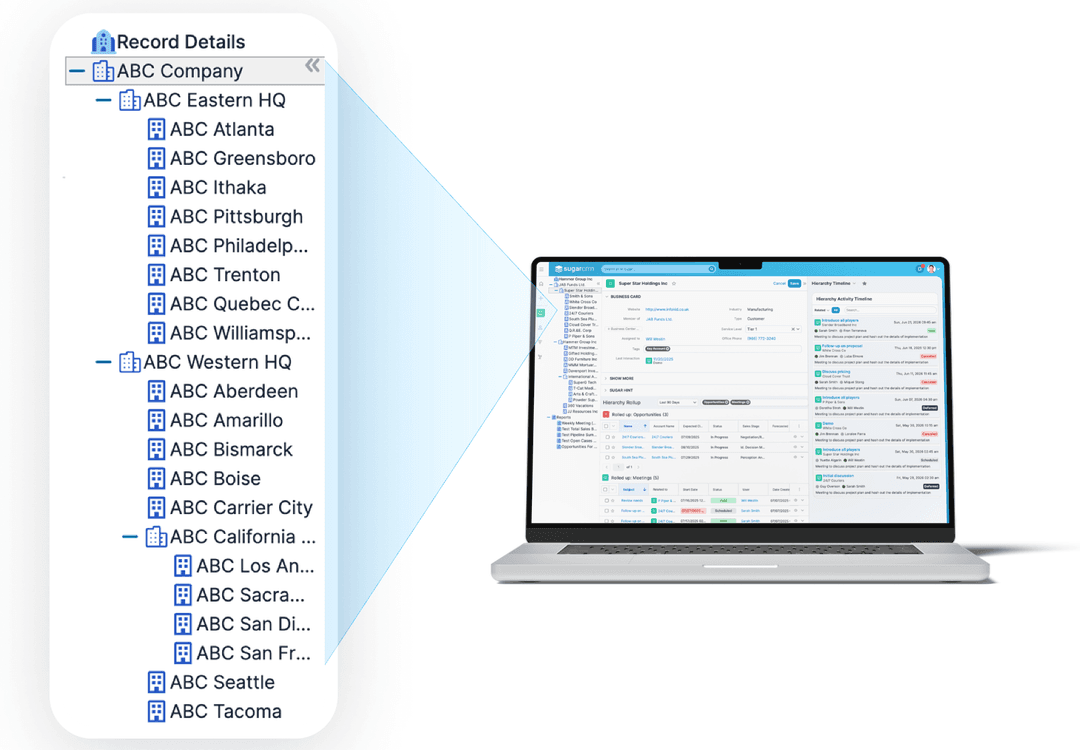

Rolling Up Multi-Location Intelligence

For manufacturers serving complex customers with multiple facilities, the ability to aggregate information across locations becomes transformative. Consider what becomes visible:

Purchasing patterns. While corporate negotiates contracts, individual plants have different ordering behaviors - monthly bulk orders at one location, weekly just-in-time at another, frequent rush deliveries at a third. This enables location-specific inventory solutions.

Production insights. Aggregating service notes reveals that three plants are running similar equipment needing replacement parts within 18 months. Instead of waiting for emergency orders, you proactively propose preventive maintenance across all locations - positioning yourself as a strategic partner.

Service trends. When tickets from multiple locations roll up, patterns emerge. Facilities in humid climates experience premature seal failures; cold regions report different issues. This intelligence enables climate-specific recommendations demonstrating deep technical understanding.

Logistics coordination. Rolling up shipping data across production facilities and distribution centers reveals consolidation opportunities that reduce freight costs for both organizations.

Relationship mapping. Capturing interactions across sites reveals which divisions have strong relationships and which need attention - identifying whitespace opportunities like untapped engineering groups.

From Data to Strategic Advantage

When your executive prepares for that customer headquarters meeting, they access a comprehensive account summary showing total relationship value across all locations, revenue trends by facility, service history with resolution patterns, relationship strength indicators, emerging opportunities, and risk factors.

Your sales team becomes more effective because they see what colleagues learned at other customer locations. Your service organization identifies patterns before they become problems. Your executives build stronger strategic relationships because they demonstrate deep understanding of each customer's complete business.

Moving Forward

The question for manufacturing leaders isn't whether field sales intelligence matters - that's obvious. The question is whether your organization has the systems in place to capture, share, and leverage that intelligence effectively.

At TCP Americas, we've seen firsthand how manufacturers transform customer relationships when they connect field intelligence with operational data. By integrating solutions like SugarCRM with Epicor ERP, we help manufacturing organizations turn scattered field knowledge into strategic advantage.

When your executives walk into that next major customer meeting, will they be half-prepared with hastily compiled notes? Or will they demonstrate the deep partnership understanding that separates strategic suppliers from transactional vendors?